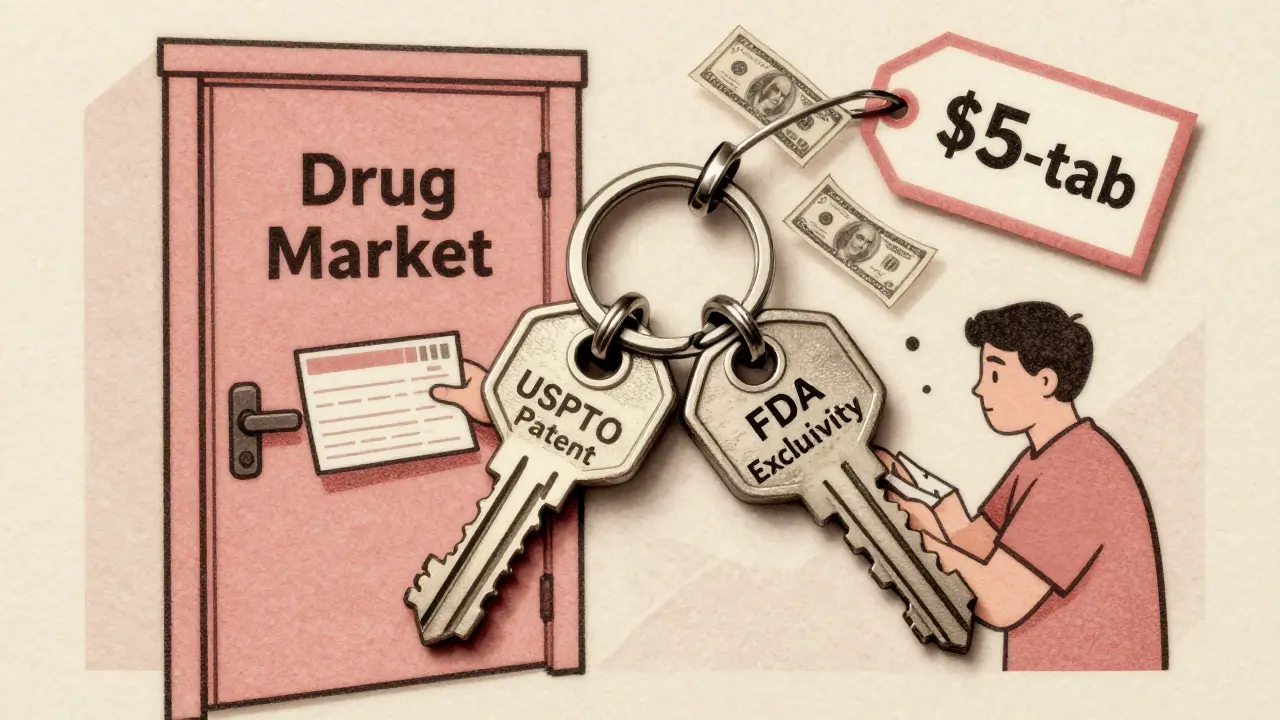

When a new drug hits the market, it doesn’t just have a price tag-it has a clock. And that clock is ticking under two different systems: patent exclusivity and market exclusivity. They sound similar, but they’re not the same. One comes from the patent office. The other comes from the FDA. And confusing them can cost companies millions-or block life-saving generics from reaching patients.

Patent Exclusivity: The Legal Shield from the Patent Office

Patent exclusivity is what you get when you invent something new. In pharmaceuticals, that usually means a new chemical compound, a unique way to make it, or a new use for an old drug. The U.S. Patent and Trademark Office (USPTO) grants this protection under federal law. It lasts 20 years from the day the patent application is filed.

But here’s the catch: most drugs take 10 to 15 years just to get approved by the FDA. That means by the time a drug actually hits shelves, you’ve already used up half your patent life. A drug filed in 2010 might not be approved until 2022, leaving only 8 years of real market protection.

That’s why companies often apply for Patent Term Extension (PTE). If the FDA’s review caused delays, the law lets you add back up to 5 years-but the total protected time after approval can’t go past 14 years. So if your patent expires in 2030, but your drug was approved in 2025, you can’t extend past 2039.

Patents protect inventions. Not the drug’s approval. Not the data behind it. Just the specific chemical structure, formula, or method. If a competitor finds a different way to make the same drug, they might not be breaking your patent-even if it does the exact same thing.

Market Exclusivity: The FDA’s Gatekeeper

Market exclusivity is the FDA’s tool. It doesn’t care if the drug is patented. It doesn’t care if it’s new. It only cares: Did you do the clinical trials yourself? If yes, then for a set period, the FDA won’t approve any generic or biosimilar version-even if there’s no patent in the way.

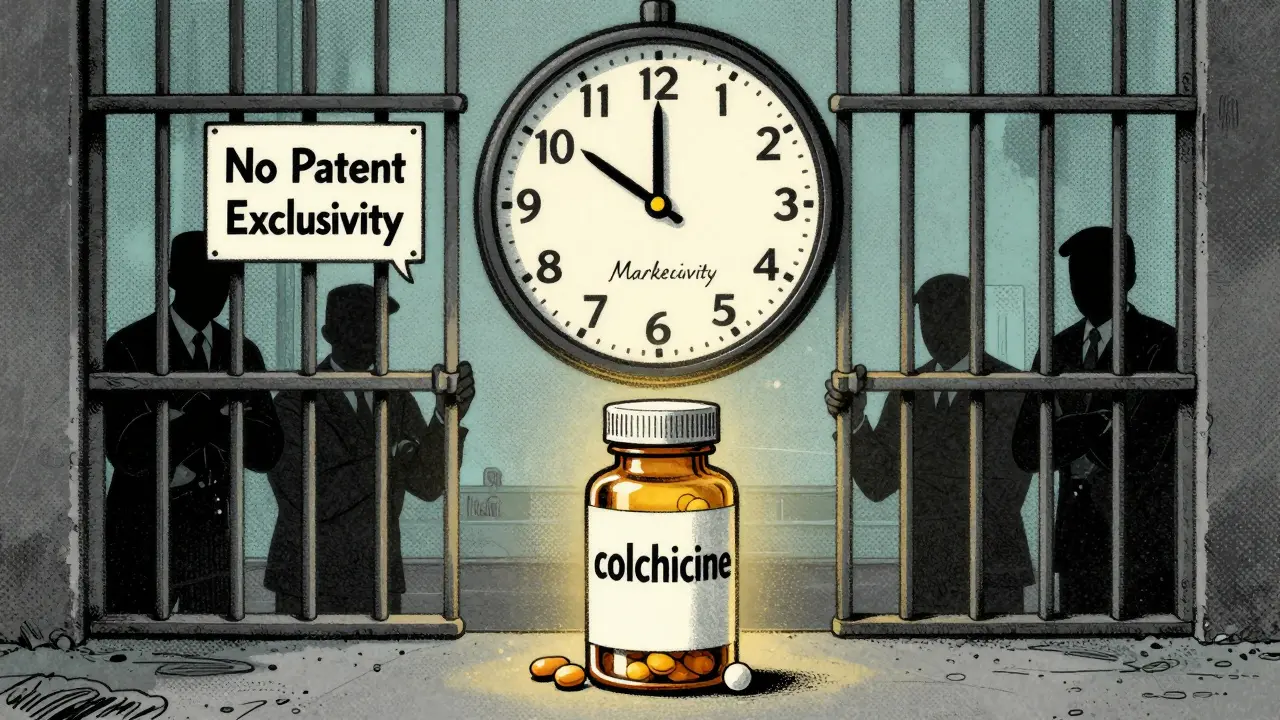

This is where things get powerful. Take colchicine. It’s been used since ancient Egypt to treat gout. No one owned a patent on it. But in 2010, Mutual Pharmaceutical got 10 years of market exclusivity after submitting new clinical data to prove its safety and effectiveness. The price jumped from 10 cents to $5 per tablet overnight. No patent. Just exclusivity.

The FDA grants several types of market exclusivity:

- New Chemical Entity (NCE): 5 years. During this time, the FDA won’t even look at a generic application.

- Orphan Drug Exclusivity: 7 years. For drugs treating rare diseases (under 200,000 U.S. patients). Even if the drug isn’t new, if it’s for a rare condition, you get this.

- Pediatric Exclusivity: 6 months added to any existing patent or exclusivity. Companies get this by running extra studies on children, even if the drug was never tested on them before.

- Biologics Exclusivity: 12 years. For complex drugs made from living cells-like Humira or Enbrel. This is separate from patents and doesn’t apply to traditional pills.

- 180-Day Exclusivity: Given to the first generic company that successfully challenges a listed patent. This is a big deal-it’s worth $100 million to $500 million in extra sales.

Unlike patents, market exclusivity is automatic. The FDA enforces it. No lawsuits. No legal filings. Just a decision in their system. If you qualify, you get it.

They Don’t Always Overlap-And That’s the Problem

Many assume if a drug has a patent, it’s protected. Or if it’s approved, it’s automatically exclusive. That’s not true.

According to FDA data from 2021:

- 38.4% of branded drugs had patents but no regulatory exclusivity

- 5.2% had exclusivity but no patents

- 27.8% had both

- 28.6% had neither

That last group? They’re the ones you’ll find on the shelf at Walmart or CVS as generics-because no one claimed protection. But the 5.2% with exclusivity but no patent? That’s where the real surprises happen.

Take Trintellix, an antidepressant. Its main patent expired in 2021. But the FDA had granted 3 years of exclusivity based on new clinical data. Teva, a generic maker, waited. They were ready. But they couldn’t launch until 2024. That delay cost them an estimated $320 million.

Small biotech companies often don’t realize this. A 2022 survey by the Biotechnology Innovation Organization found that 43% of them mistakenly thought patent protection meant market exclusivity. They spent millions on patent lawyers-then missed the FDA paperwork for exclusivity. Result? Lost revenue. Lost time.

Why This Matters to Patients and Prices

These rules don’t just affect drug companies. They affect your prescription bill.

Branded drugs make up just 12% of prescriptions in the U.S. But they account for 68% of total spending. Why? Because exclusivity delays competition. When generics enter, prices often drop 80-90%.

But if exclusivity lasts longer than the patent, generics can’t come in-even if the patent is dead. That’s why 78% of drugs with exclusivity but no patent still had no generic competition during their exclusivity period, according to the Congressional Research Service.

And it’s getting worse. In 2022, 58% of new drugs had no composition-of-matter patent but still got regulatory exclusivity. That means companies are relying less on inventing new chemicals-and more on tweaking old ones, doing new studies, and locking in exclusivity.

McKinsey predicts that by 2027, regulatory exclusivity will be the main source of market protection for new drugs-surpassing patents. That’s a huge shift. It means the FDA, not the patent office, is becoming the gatekeeper of drug access.

What’s Changing in 2024 and Beyond

The rules aren’t static. In January 2024, the FDA started requiring more detailed justifications for exclusivity claims. Companies can’t just say “we did the studies”-they have to prove exactly which data they submitted and why it qualifies.

The FDA also launched its Exclusivity Dashboard in September 2023. Now, anyone can see which drugs have active exclusivity, when it expires, and what type it is. That’s good for transparency-but it’s also a signal to generic makers: Here’s your next target.

Legislation is moving too. The PREVAIL Act of 2023 proposes cutting biologics exclusivity from 12 to 10 years. Meanwhile, global debates are brewing about whether exclusivity should be waived for essential medicines-like it was for COVID vaccines.

One thing’s clear: the balance between innovation and access is shifting. And it’s no longer just about patents.

What You Need to Remember

Patent exclusivity = invention protection. Filed with the patent office. 20 years from filing. Can be extended. Requires legal enforcement.

Market exclusivity = approval protection. Granted by the FDA. Varies by drug type. Automatic. Doesn’t require a patent. Can block generics even when patents are gone.

They’re two different keys. One opens the door to legal action. The other opens the door to the market.

If you’re a patient, know this: your drug might be expensive not because it’s new-but because the system is designed to delay cheaper versions. If you’re a manufacturer, don’t assume your patent is enough. File for exclusivity. Miss it, and you lose years of revenue.

The real question isn’t whether a drug is patented. It’s whether it’s exclusive. And that’s a question only the FDA can answer.

Comments

Doreen Pachificus

So basically the FDA is the real gatekeeper now, not the patent office? That’s wild. I always thought patents were the main shield, but this makes sense-companies are gaming the system by tweaking old drugs instead of inventing new ones.

January 3, 2026 AT 13:00

Charlotte N

colchicine going from 10 cents to 5 bucks overnight just because someone did a study on it?? that’s insane. no patent no innovation just paperwork and monopoly. the system is broken

January 3, 2026 AT 15:12

Catherine HARDY

They’re not just protecting drugs-they’re protecting profits. The FDA’s exclusivity rules? Totally manufactured by Big Pharma lobbying. You think they care about patients? Nah. They want you stuck paying $500 for a pill that could be 50 cents. And don’t get me started on the ‘Exclusivity Dashboard’-it’s not transparency, it’s a hit list for generics. They’re setting up the next wave of corporate raids.

January 4, 2026 AT 21:10

Siobhan Goggin

This is such an important breakdown. I never realized how much of drug pricing comes down to FDA paperwork rather than actual innovation. It’s frustrating, but at least now I understand why some generics take years to appear-even when the patent’s expired. Hope this awareness spreads.

January 5, 2026 AT 21:37

Shanna Sung

12 years for biologics? That’s a joke. These companies are just rebranding old science and calling it innovation. The FDA is a puppet. Congress is a puppet. And we’re the ones paying $10,000 a month for insulin because someone filed the right form. Wake up people. This isn’t medicine. It’s corporate theater.

January 6, 2026 AT 11:40

josh plum

Look, I get it. Innovation costs money. But when you take a 100-year-old compound and slap a new study on it to lock out generics for a decade, you’re not a hero-you’re a parasite. The patent system was designed to reward creation, not manipulation. The FDA’s letting them get away with it. And we’re all paying the price.

January 8, 2026 AT 03:23

John Ross

Let’s clarify the terminology here. Patent exclusivity is a statutory IP right under 35 U.S.C. §154, while market exclusivity is a regulatory barrier under 21 U.S.C. §355(c)(3)(E) and §355(j)(5)(F). The former is subject to term adjustment under §156, the latter is non-negotiable upon regulatory approval. The 2021 FDA data reflects strategic portfolio diversification-companies are hedging against patent invalidation by layering regulatory protections. It’s not corruption, it’s risk mitigation in a high-stakes regulatory environment.

January 8, 2026 AT 08:36

Clint Moser

wait so if a drug has no patent but gets market exclusivity… that means someone can just copy the formula and sell it cheaper but the fda won’t let them? that’s not right. i mean like… how is that fair? i think the fda is just being lazy and letting pharma push them around. also i think they misspelled ‘colchicine’ in the article lol

January 10, 2026 AT 01:10

Ashley Viñas

It’s not just about the science-it’s about the power structure. The FDA’s exclusivity system was designed to incentivize clinical research, but now it’s weaponized by well-funded corporations to suppress competition. Small biotechs? They don’t have the legal teams to navigate this. The system rewards the wealthy, not the innovative. And patients? They’re collateral damage in a game of regulatory chess. This isn’t healthcare policy-it’s corporate capture dressed in bureaucratic language.

January 10, 2026 AT 10:24

Brendan F. Cochran

America built the best pharma industry in the world. You think other countries are letting their companies sit around waiting 12 years for exclusivity? No. They’re stealing our drugs and making generics. We protect our innovation, or we fall behind. If you want cheap drugs, go to India. But don’t cry when your cancer med isn’t available anymore.

January 10, 2026 AT 13:19

jigisha Patel

The data presented is statistically significant but methodologically flawed. The 2022 BIO survey lacks control variables regarding company size and R&D expenditure. Furthermore, the McKinsey projection assumes linear growth in regulatory exclusivity adoption, ignoring potential legislative intervention. The Congressional Research Service data does not account for the time lag between exclusivity expiration and generic market entry. This analysis is reductive and dangerously oversimplified.

January 12, 2026 AT 10:45

Mandy Kowitz

So let me get this straight… you spend $2 billion developing a drug, then get 5 years of exclusivity? Meanwhile, someone else spends $50k on a study and gets 10 years? That’s not capitalism. That’s a rigged game. And the FDA is the dealer with all the aces.

January 12, 2026 AT 20:26

Jason Stafford

They’re not just delaying generics-they’re delaying death. My mom took Trintellix. She couldn’t afford the brand. The generic came out three years after the patent expired. She died six months before it hit shelves. This isn’t policy. It’s murder by bureaucracy. And the people writing these rules? They don’t even know what a pill looks like.

January 14, 2026 AT 02:54