Brand-name drugs can cost hundreds - sometimes over a thousand - dollars a month. If you're insured but still struggling to afford your medication, you're not alone. Manufacturer savings programs exist to help, but they’re not simple to use. They come with hidden rules, eligibility traps, and sudden cutoffs. But if you know how to navigate them, you can slash your monthly drug bill by 70% or more.

What Are Manufacturer Savings Programs?

These are discounts offered directly by drug makers - like Eli Lilly, AbbVie, or Sanofi - to help people pay for expensive brand-name medications. The two main types are copay cards and patient assistance programs (PAPs).

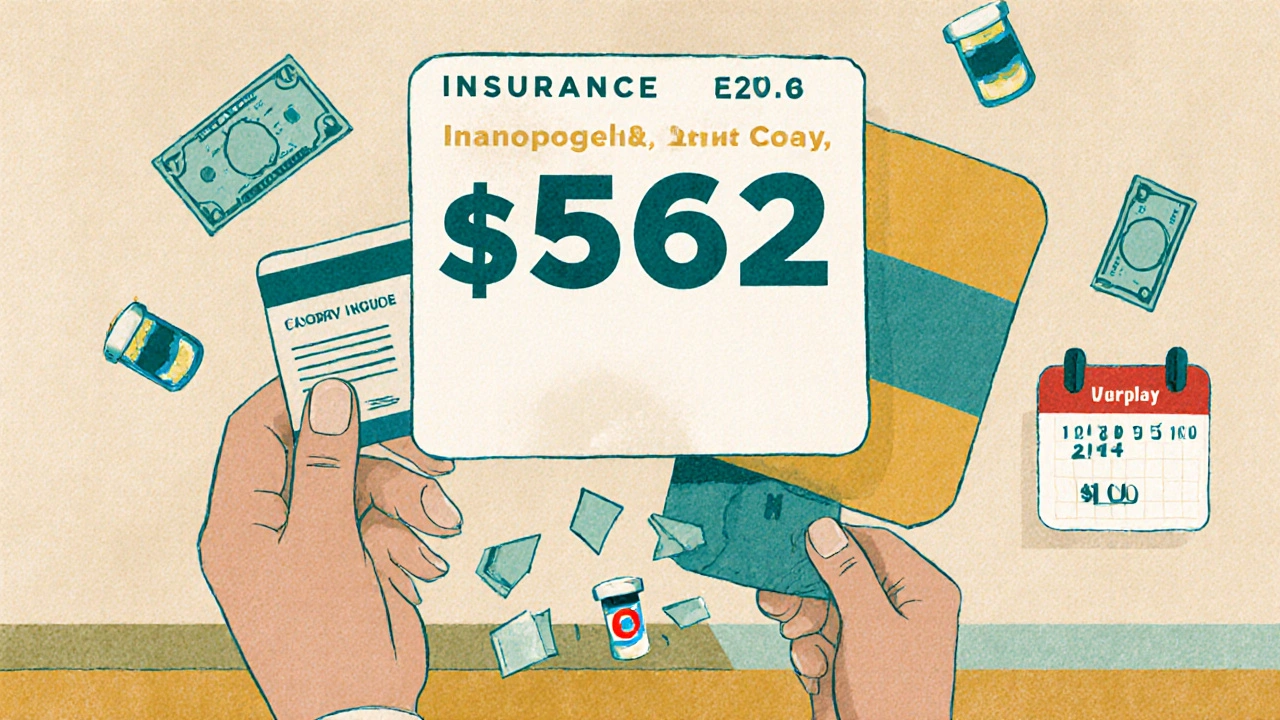

Copay cards work like coupons. When you fill your prescription, the card reduces what you pay at the pharmacy. For example, if your insulin costs $562 a month, a copay card might bring it down to $100. Patient assistance programs are usually for people with very low income, offering free or deeply discounted drugs - but they’re harder to qualify for.

These programs aren’t charity. They’re business tools. Drug companies use them to keep patients on expensive brand-name drugs instead of switching to cheaper generics. In 2023, nearly one-third of all brand-name prescriptions in the U.S. used some kind of manufacturer discount. That’s $23 billion in savings paid out by drug makers - mostly to people with private insurance.

Who Can Use These Programs?

You can only use these programs if you have private insurance. If you’re on Medicare, Medicaid, or any other federal health program, you’re excluded. That’s not an accident. Federal law bans drug makers from giving discounts to people on government plans because it could push them toward pricier drugs.

Even if you have private insurance, your plan might block you. Many employers now use accumulator adjustment programs. These mean your copay card discount doesn’t count toward your deductible or out-of-pocket maximum. So you pay less now, but you still have to hit your full deductible later. That can cost you thousands more by year’s end.

Check your insurance documents or call your plan’s customer service. Ask: "Does my plan allow manufacturer copay assistance to count toward my deductible?" If the answer is no, you’re playing a losing game.

How to Find and Enroll in a Program

Start with the drug’s manufacturer website. Search for the brand name + "patient assistance" or "copay card." For example, search "Humira copay card" or "Jardiance savings program."

Most big drug companies have a dedicated page for this. You’ll fill out a quick form with your:

- Full name

- Date of birth

- Insurance info (plan name, member ID)

- Prescription details (drug name, dosage, prescriber)

After submitting, you’ll get a digital card via email or text. Some send a physical card in the mail. You can also use third-party sites like GoodRx or RxAssist to find programs faster. GoodRx alone lists over 70% of major brand-name drug savings options.

Don’t skip this step: make sure your pharmacy accepts the program. Not all pharmacies do. Call ahead or check the manufacturer’s site for a list of participating pharmacies.

How It Works at the Pharmacy

When you show up to pick up your prescription, hand over your insurance card and your copay card. The pharmacist will scan both. Behind the scenes, a third-party administrator - like ConnectiveRx or Prime Therapeutics - checks your eligibility, applies the discount, and bills the drug maker for the rest.

You pay only your reduced copay. The rest is covered by the manufacturer. No extra paperwork. No reimbursements. It’s automatic.

But here’s the catch: these programs have limits. Most cap annual savings between $5,000 and $15,000. Once you hit that limit, you pay full price again. Many also expire after 12 or 24 months. You’ll need to reapply. Some programs auto-renew. Others don’t. Set a calendar reminder.

What You Can’t Do With These Programs

These savings don’t work for generics. If your doctor prescribes a generic version of your drug, the manufacturer’s card won’t help. That’s intentional. The goal is to keep you on the brand-name drug.

You also can’t use them if you’re uninsured. Some manufacturers offer PAPs for the uninsured, but those are separate programs with stricter income rules. You’ll need to prove income with tax returns or pay stubs.

And if your insurance plan has an accumulator program, your card discount won’t move you closer to your out-of-pocket maximum. That means you might pay $100 a month now - but still owe $7,000 more before your insurance kicks in. That’s a trap many don’t see until it’s too late.

Manufacturer Programs vs. Pharmacy Discount Cards

Don’t confuse manufacturer copay cards with pharmacy discount cards like GoodRx or SingleCare. They’re different.

| Feature | Manufacturer Copay Card | Pharmacy Discount Card (e.g., GoodRx) |

|---|---|---|

| Works for brand drugs? | Yes | Yes |

| Works for generics? | No | Yes |

| Eligibility | Private insurance only | No insurance needed |

| Average savings | 70-85% | 30-60% |

| Counts toward deductible? | Usually not (if accumulator program) | No |

| Annual cap | Yes ($5K-$15K) | No |

| Expiration | 12-24 months | Never |

GoodRx is great if you’re uninsured or your manufacturer card doesn’t work. But if you’re eligible for a copay card, it’s almost always the better deal - if your plan allows it.

Real Stories: What Users Say

People on Reddit and Drugs.com share their experiences. One user on r/healthinsurance wrote: "My Jardiance was $562 a month. With the coupon, I pay $100. I’ve saved over $5,000 this year. But I just got a notice - the program ends in 3 months. Now I’m terrified."

Another said: "I used Humira’s copay card for two years. Then it vanished. My monthly cost jumped from $120 to $1,200. I had to go on disability."

These aren’t rare cases. In 2023, 42% of users reported their savings program suddenly ended or was blocked by their insurance. That’s why you need a backup plan.

How to Protect Yourself

Don’t rely on one program. Here’s what to do:

- Always check if your plan allows copay assistance. Ask your insurer in writing.

- Set reminders for when your card expires. Mark the date on your phone.

- Keep a printed copy of your card and the manufacturer’s contact info.

- Ask your pharmacist: "Is this program still active? Are there any changes?" They often know before you do.

- Have a backup. If your copay card stops working, check GoodRx or RxAssist for lower cash prices.

- Call your doctor. Ask if a generic or alternative drug is available. Sometimes, switching saves more than any coupon.

And if your plan blocks your discount, you’re not powerless. As of 2023, 32 states have passed laws banning accumulator programs. Check your state’s health department website. You might be able to file a complaint or get help.

The Bigger Picture

These programs help people today. But they also keep drug prices high. Experts like Dr. Robin Feldman say they distort the market - encouraging drug makers to charge more because they know patients will get discounts anyway. The result? Everyone else pays more in premiums.

Still, for the person standing at the pharmacy counter with a $600 bill, these programs are lifelines. Use them wisely. Know the rules. Plan ahead. And never assume the discount will last forever.

Drug companies aren’t giving you money because they care. They’re doing it because it’s good for business. But if you use it right, you can turn their business strategy into your financial win.

Can I use manufacturer savings programs if I’m on Medicare?

No. Federal law prohibits drug manufacturers from offering copay cards or discounts to people enrolled in Medicare, Medicaid, or other government health programs. This is to prevent financial incentives that could push beneficiaries toward more expensive brand-name drugs. If you’re on Medicare Part D, you may qualify for other help, like the Low-Income Subsidy (LIS) or the insulin cost cap of $35 per month under the Inflation Reduction Act.

Why does my copay card not count toward my deductible?

Many insurance plans use "accumulator adjustment programs" that prevent manufacturer discounts from counting toward your deductible or out-of-pocket maximum. This means you pay less now, but you still have to meet your full deductible later. These programs are common - 87% of large employers used them by 2022. Check your plan documents or call customer service to confirm if yours does.

How long do manufacturer copay programs last?

Most copay programs last 12 to 24 months, but some expire sooner. Many have annual caps - usually between $5,000 and $15,000 in savings. Once you hit that limit, you pay full price again. Some programs auto-renew; others require you to reapply. Always check the terms when you enroll and set calendar reminders before expiration.

Can I use a manufacturer coupon with GoodRx?

No. You can’t combine manufacturer copay cards with pharmacy discount cards like GoodRx. At the pharmacy, you must choose one or the other. The manufacturer card usually gives a bigger discount on brand-name drugs, but GoodRx works for both brand and generic and doesn’t expire. Always compare both options before filling your prescription.

What if my copay card stops working suddenly?

If your copay card stops working, first contact the manufacturer’s patient support line - they may be able to extend it or offer alternatives. Next, check GoodRx or RxAssist for cash prices. Talk to your doctor about switching to a generic or lower-cost alternative. If your insurance blocked the discount, file a complaint with your state’s insurance commissioner - 32 states now ban accumulator programs.

Comments

Victoria Short

This is way too much work just to save money on pills.

November 16, 2025 AT 14:30

Liam Dunne

I used this for my diabetes med last year. Saved me $4,200. Then the card dropped out like it never existed. My pharmacy said it was "expired"-but I’d only been on it six months. No warning. No email. Just... gone. Had to scramble for GoodRx. Not cool.

November 17, 2025 AT 02:56

Connor Moizer

If your insurance is blocking your copay card, you’re not being helped-you’re being exploited. Accumulator programs are a scam disguised as cost containment. They make you think you’re saving money while actually forcing you to pay more later. Call your state’s insurance commissioner. They’re starting to crack down on this.

November 17, 2025 AT 09:04

kanishetti anusha

I’m from India and I’ve been watching this system from afar. It’s heartbreaking. In my country, even basic insulin is unaffordable without government subsidies. Here, people are playing a game with coupons and expiration dates just to survive. I hope someone fixes this soon.

November 19, 2025 AT 06:46

Eric Gregorich

Let’s be real-this whole system is a theater of cruelty. Drug companies charge $600 for a pill, then give you a $500 coupon so you feel like you’re winning, while they quietly raise prices every year knowing you’ll be too desperate to switch. They’re not helping you-they’re conditioning you. And when the card expires? That’s when the real cost hits. You’re not a patient. You’re a customer in a rigged casino. And the house always wins. The fact that we’ve normalized this as "smart shopping" says everything about how broken our healthcare system is.

November 20, 2025 AT 09:08

Willie Randle

Always verify with your pharmacy before you go. I once showed up with my Humira card and they said, "We don’t process that one anymore." Turned out the manufacturer changed their partner administrator. I had to call the drug company’s help line, wait 47 minutes, and get a new card emailed. Don’t assume it works. Confirm. Every. Single. Time.

November 20, 2025 AT 18:40

Jessica M

It is imperative that individuals utilizing manufacturer savings programs remain vigilant regarding program terms and conditions. Eligibility criteria, annual caps, and accumulator adjustments are frequently updated and may not be communicated proactively. Patients are strongly advised to maintain written documentation of all communications with insurers and manufacturers, and to request confirmation of continued eligibility in writing prior to each prescription fill. Failure to do so may result in catastrophic financial exposure.

November 21, 2025 AT 13:48

Phil Best

Let me tell you something: if you’re relying on a coupon to stay alive, you’re already losing. These programs exist because the system is designed to break you. They’re not solutions-they’re bandaids on a hemorrhage. And when the card runs out? That’s when the real horror show begins. You think you’re getting help? Nah. You’re being groomed for the next price hike.

November 23, 2025 AT 03:25

Parv Trivedi

As someone from India, I find this both inspiring and troubling. We don’t have these programs here, but we also don’t have $600 insulin. Maybe the answer isn’t more coupons, but more regulation. Still, for now, if this helps someone breathe today, I’m glad it exists. Just don’t forget to plan for tomorrow.

November 24, 2025 AT 02:11

Patrick Merk

Man, I love how Americans turn survival into a hobby. You’ve got spreadsheets for your copay cards, calendar alerts for when your savings expire, and entire Reddit threads debating whether GoodRx or RxAssist gives a better discount on Jardiance. It’s like a game of financial Tetris-and the blocks are your health. Respect the hustle, but damn… we’ve really let things get weird.

November 25, 2025 AT 11:40

Vera Wayne

PLEASE-set a reminder for your card expiration date. I missed mine. I thought it auto-renewed. I didn’t check. And then I got the bill. $1,187. For ONE prescription. I cried in the pharmacy parking lot. Don’t be me. Set. The. Reminder.

November 26, 2025 AT 13:33

Koltin Hammer

There’s a deeper truth here that nobody wants to talk about: these programs aren’t about helping patients-they’re about keeping brand-name drugs relevant. If generics were truly cheaper and just as effective, drug companies wouldn’t spend billions on these coupons. They’d be fine with the market doing its job. But they’re not. They’re betting that you’ll be too tired, too scared, too confused to switch. And most of the time, you are. So they win. You pay more over time. Your insurer pays more. Everyone loses except the shareholders. It’s not a loophole. It’s a trap wrapped in a gift bow.

November 28, 2025 AT 12:01

roy bradfield

Did you know that the same companies that give you copay cards are the ones lobbying Congress to block Medicare from negotiating drug prices? They’re using your desperation to fight for higher prices for everyone. They give you $500 off so you’ll vote against price controls. This isn’t charity. It’s psychological manipulation on a national scale. And they’re counting on you to be too busy surviving to notice.

November 29, 2025 AT 07:47