Why does your $4 generic medication cost $45 when you use insurance-but only $4 if you pay cash? It’s not a mistake. It’s the result of a hidden system where insurance companies, pharmacies, and middlemen called Pharmacy Benefit Managers (PBMs) negotiate prices behind closed doors. This isn’t about saving money. It’s about who gets paid, how much, and who’s left footing the bill.

Who Really Controls Generic Drug Prices?

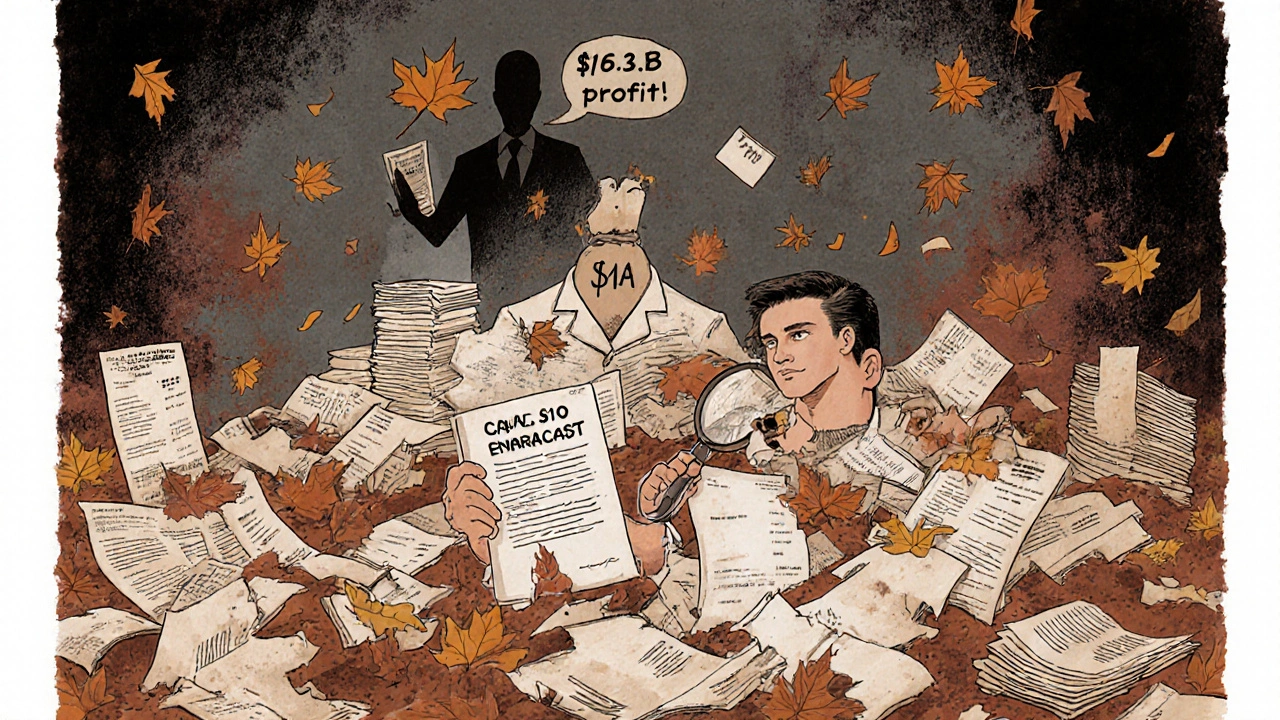

You might think your insurer sets the price for your generic pills. But they don’t. The real power lies with Pharmacy Benefit Managers-three big companies: OptumRx, CVS Caremark, and Express Scripts. Together, they handle about 80% of all prescription drug claims in the U.S. They’re not pharmacies. They’re not insurers. They’re middlemen with contracts that no one else can see. These PBMs don’t just negotiate prices. They decide which drugs are covered, which aren’t, and how much pharmacies get paid to fill them. They create something called a Maximum Allowable Cost (MAC) list. This is the maximum amount they’ll reimburse a pharmacy for a generic drug. But here’s the catch: that number is often lower than what the pharmacy actually paid to buy the drug.The Secret Behind the Price Gap: Spread Pricing

PBMs charge your insurance plan one price for a drug-say, $45 for a 30-day supply of metformin. Then they pay the pharmacy a lower amount-maybe $10. The $35 difference? That’s called spread pricing. It’s pure profit for the PBM, hidden from you, your doctor, and even your insurer in many cases. This isn’t theoretical. In 2024, industry analysts estimated PBMs made $15.2 billion in hidden profits from spread pricing alone, and 68% of that came from generic drugs. That’s billions of dollars taken from the system without any benefit to patients. And it gets worse. Because PBMs are paid based on the list price of drugs, not the actual cost, they have an incentive to push higher-priced generics-even if they’re just as effective as cheaper ones. Why? Higher list prices mean bigger rebates from manufacturers, which PBMs keep instead of passing them to you.Why Your Insurance Doesn’t Save You Money

Most people assume using insurance means lower costs. But for generics, that’s often not true. A 2024 Consumer Reports survey found that 42% of insured adults paid more out-of-pocket for a generic drug than they would have if they’d paid cash. Some cases were extreme: one Reddit user reported paying $45 for a generic with insurance, while the cash price at the same pharmacy was $4. This happens because of how copays are structured. Insurers often set flat copays-$5, $10, $15-for generics. But if the PBM’s negotiated price is lower than that copay, the pharmacy still gets paid the copay amount. The rest? That’s kept by the insurer or PBM. So you’re paying more than the drug actually costs. Even worse, many pharmacies are legally barred from telling you about cheaper cash prices. These are called gag clauses. Until recently, 92% of PBM contracts included them. While some states have banned them, they’re still common. So you walk into the pharmacy thinking you’re using insurance to save money-and you’re actually paying more.

How Pharmacies Are Getting Crushed

Independent pharmacies are caught in the middle. They buy drugs at wholesale prices. Then they’re forced to accept reimbursement rates from PBMs that are often below cost. To make up the difference, they rely on volume. But PBMs keep shrinking their networks, cutting out smaller pharmacies. Between 2018 and 2023, over 11,300 independent pharmacies closed. Why? Because PBMs don’t just underpay-they claw back money after the fact. A pharmacy fills a prescription, gets paid $10, then weeks later, the PBM says, “Oops, we made a mistake. You should’ve only gotten $6.” That’s called a clawback. Sixty-three percent of independent pharmacies reported being hit by clawbacks in 2023. Pharmacists now spend 200 to 300 hours a year just trying to understand PBM contracts. They need expensive software to track different reimbursement rules. And they have to run two pricing systems: one for insurance, one for cash. That’s not efficiency. That’s chaos.What’s Being Done About It?

Pressure is building. In September 2024, the Biden administration issued an executive order banning spread pricing in federal programs like Medicare and Medicaid. That change takes effect in January 2026. Fourteen states have already passed laws requiring PBMs to disclose their pricing practices. The Pharmacy Benefit Manager Transparency Act of 2025 proposes forcing PBMs to pass 100% of rebates to insurers. The Inflation Reduction Act’s Medicare Drug Price Negotiation Program is also starting to ripple through the private market. When the government negotiates lower prices for 20 drugs in 2025, PBMs will have to adjust their MAC lists. That could push down prices for other generics too. But don’t expect miracles. The pharmaceutical industry still argues that this system funds innovation. And PBMs say they save money. But the data tells a different story: patients pay more, pharmacies struggle, and middlemen profit.

What You Can Do Right Now

You don’t have to wait for policy changes to save money. Here’s what works:- Always ask the pharmacist: “What’s the cash price?” Even if you have insurance, the cash price is often lower.

- Use apps like GoodRx, SingleCare, or Cost Plus Drugs. They show real-time cash prices and often beat insurance copays.

- Check if your pharmacy offers a discount program. Some independent pharmacies have their own $4 generic lists.

- If you’re paying more than $10 for a common generic (like lisinopril or atorvastatin), you’re likely being overcharged.

- Ask your doctor if they can prescribe a drug on the cash discount list. Many generics are interchangeable.

The Bigger Picture

The U.S. spends $620 billion a year on prescription drugs. Generics make up 90% of prescriptions-but only 23% of total spending. That’s because brand-name drugs are astronomically expensive. But for the generics you take every day, the system is broken. The problem isn’t the drugs. It’s the way they’re priced. PBMs aren’t saving you money. They’re turning your prescription into a profit center. And until that changes, the only way to truly save is to bypass the system entirely.Next time you fill a prescription, don’t assume insurance is helping. Ask for the cash price. It might be the only way to know what the drug actually costs.

Comments

Andrew Montandon

Wow, this is wild. I had no idea my $10 copay for metformin was actually costing the system $45. I always thought insurance was helping me save money, but now I realize I’m just funding some middleman’s luxury yacht. 🤯

I started using GoodRx last year after my pharmacist casually mentioned the cash price was $3. I’ve saved over $300 just on generics. Why isn’t this common knowledge?

And don’t even get me started on clawbacks. My uncle’s independent pharmacy got hit with a $12,000 clawback last year-just for filling prescriptions they already got paid for. He had to lay off two staff. That’s not business. That’s theft.

Why do we let these PBMs operate like black boxes? They’re not regulated like banks, but they control more of our healthcare than our doctors. It’s insane.

I’ve started asking every pharmacist: ‘What’s the cash price?’ Every time, it’s lower. Why does the system punish people for asking?

Also, why do insurance companies even bother with generics? If the cash price is lower, and the PBM keeps the spread, isn’t it just a money funnel?

Someone needs to make a TikTok series on this. People need to see this.

And yes, I know PBMs say they ‘negotiate’-but if the negotiation happens behind closed doors and no one knows the terms, that’s not negotiation. That’s extortion.

I’m not anti-insurance. I’m anti-secret pricing. Transparency should be the baseline, not the exception.

Thank you for writing this. I’m sharing it with my entire family.

November 20, 2025 AT 14:19

Sam Reicks

pbms are just a distraction bro. the real culprits are the feds. they created this mess by letting big pharma buy congress. now we got this whole system where the gov pays for meds but lets middlemen skim. its all a psyop to keep us distracted while they raise the price of insulin to 1000 bucks. dont fall for the fake enemy.

November 21, 2025 AT 21:01

Chuck Coffer

So let me get this straight. You’re telling me pharmacists are forced to lose money on every generic they sell, while some guy in a Connecticut office gets a bonus for ‘negotiating’ a price that doesn’t exist?

And you’re surprised people are broke?

Wow. Just... wow.

November 22, 2025 AT 17:33

Marjorie Antoniou

This made me cry. My mom takes six generics. She pays $15 copay each time. I found out last month the cash price was $2.50. She’s 72. She doesn’t use apps. She trusts her insurance. She feels guilty asking for cheaper options. We’re failing people like her.

I’m printing this out and taking it to her next visit. I’m also calling her pharmacy to ask if they offer a cash discount list. She deserves to know the truth.

November 23, 2025 AT 10:13

Andrew Baggley

Listen-I used to think this was just how healthcare worked. But after reading this, I realized something: we’re not broken. We’re being exploited.

And here’s the good news: you don’t need permission to fix this. Just ask for the cash price. That’s it. One question. One small act of rebellion.

I’ve been doing it for a year. I’ve saved $400. I told my coworkers. Now three of them do it too. It’s not a movement. It’s just common sense.

Also-use Cost Plus Drugs. Their prices are literally wholesale. No middleman. No drama. Just pills at cost. It’s like buying groceries at Costco.

We can do this. Small steps. Big impact.

November 24, 2025 AT 20:15

Codie Wagers

The real tragedy here isn’t the spread pricing. It’s the normalization of exploitation. We’ve allowed a system to emerge where the moral cost of profit is ignored, where human dignity is reduced to a reimbursement rate on a spreadsheet. The PBM is not a market actor-it is a parasitic institution that thrives on the illusion of efficiency. The patient is not a customer; they are a revenue stream. And the pharmacy? A mere vessel for extraction.

This is not capitalism. This is feudalism with a corporate logo.

Until we recognize that healthcare is a right-not a commodity-we will continue to mourn the quiet deaths of people who can’t afford the pills that keep them alive.

November 25, 2025 AT 17:17

Paige Lund

Wow. So… we’re all just pawns in a game nobody understands? Cool. I’ll just keep paying $10 for my pills. At least I’m not the one making the spreadsheets.

November 25, 2025 AT 23:06

Michael Salmon

Oh please. PBMs are the problem? Nah. It’s the government. If they didn’t subsidize insurance, this wouldn’t exist. You want lower prices? Get rid of insurance entirely. Let the market work. No more middlemen. No more ‘gag clauses.’ Just cash. Simple.

But no-people want to be coddled. They want someone else to pay for their pills. Then they’re shocked when the bill comes due.

This isn’t corruption. It’s economics. And you’re mad because you’re not getting the subsidy you think you’re owed.

November 27, 2025 AT 02:12

Joe Durham

I’ve worked in a pharmacy for 15 years. I’ve seen this up close. The worst part? We know what’s happening. We’re just powerless to stop it.

I’ve had patients cry because they chose between their meds and groceries. I’ve had to explain why their ‘insurance price’ is higher than the cash price-and been told I’m ‘not allowed’ to tell them.

But I’ve started slipping them GoodRx coupons anyway. I don’t care about the gag clause. If I’m gonna be fired for helping someone, so be it.

Thank you for naming what we’ve all been too afraid to say out loud.

November 27, 2025 AT 12:48

Christopher Robinson

Just tried this last week-asked for cash price on my generic lisinopril. $3.50. Insurance? $15. 😳

Now I use Cost Plus Drugs for all my meds. No copays. No surprises. Just pills. 🙌

Also-your pharmacist is your friend. Ask them anything. They’re on your side. 💙

November 28, 2025 AT 19:14

James Ó Nuanáin

As a British citizen, I find this utterly grotesque. In the NHS, a generic statin costs £0.90. We don’t have ‘spread pricing.’ We don’t have ‘clawbacks.’ We don’t have ‘PBMs.’ We have a system where healthcare is a right, not a profit motive. You Americans have turned medicine into a casino-and you’re shocked when the house always wins.

Perhaps it’s time you stopped pretending your system is ‘free-market’ and admitted it’s a kleptocracy with a stethoscope.

November 30, 2025 AT 03:11

Nick Lesieur

lol so the pharmacy is supposed to just eat the loss? dumb. they should raise prices on the cash side to make up for it. this whole thing is a mess. who even runs these places anymore?

November 30, 2025 AT 14:12

Angela Gutschwager

Ask for cash price. Always. I’ve saved $500/year. No apps needed. Just ask.

December 1, 2025 AT 04:40

Andrew Montandon

Just saw your comment, @4326. You’re right-it’s that simple. I told my mom last week to ask for the cash price. She was nervous. Said she didn’t want to ‘seem cheap.’ I told her: ‘It’s not cheap. It’s smart.’

She did it. Saved $12 on her blood pressure med. Came home smiling. Said, ‘I didn’t know I could do that.’

That’s the real win. Not the money. It’s knowing you have power in a system that tells you you don’t.

December 1, 2025 AT 19:15